Transforming Microfinance Operations with a Smart Member Management System: From NID Verification to Auto Evaluation

The microfinance sector plays a pivotal role in empowering small entrepreneurs, farmers, and low-income communities. Yet, traditional operations often rely on manual data entry, paper-based records, and slow verification processes. These challenges can lead to delays, errors, and a lack of transparency, ultimately slowing down financial inclusion.

A Smart Member Management System (SMMS) revolutionizes this workflow. Automating processes from NID verification to member evaluation ensures accurate identity checks, simplifies onboarding, and enables institutions to make data-driven loan decisions. In short, it transforms microfinance operations into a faster, smarter, and more reliable system.

What is a Smart Member Management System?

A Smart Member Management System is an advanced digital platform designed for microfinance institutions (MFIs) to manage their members’ entire lifecycle—from registration and verification to evaluation, loan tracking, and reporting.

Why Choose MicrofinPlus?

MicrofinPlus is more than software—it’s a strategic partner for MFIs. Built to align with MRA law and global banking standards, it digitizes and streamlines every core operation, providing complete control over finance, HR, procurement, and reporting.

Key Advantages:

- End-to-End Automation: 100% automation of loan, payroll, and member processes.

- Mobile & Web Accessibility: Manage operations remotely on any device.

- Real-Time Dashboards: Instant KPI insights and data visualization.

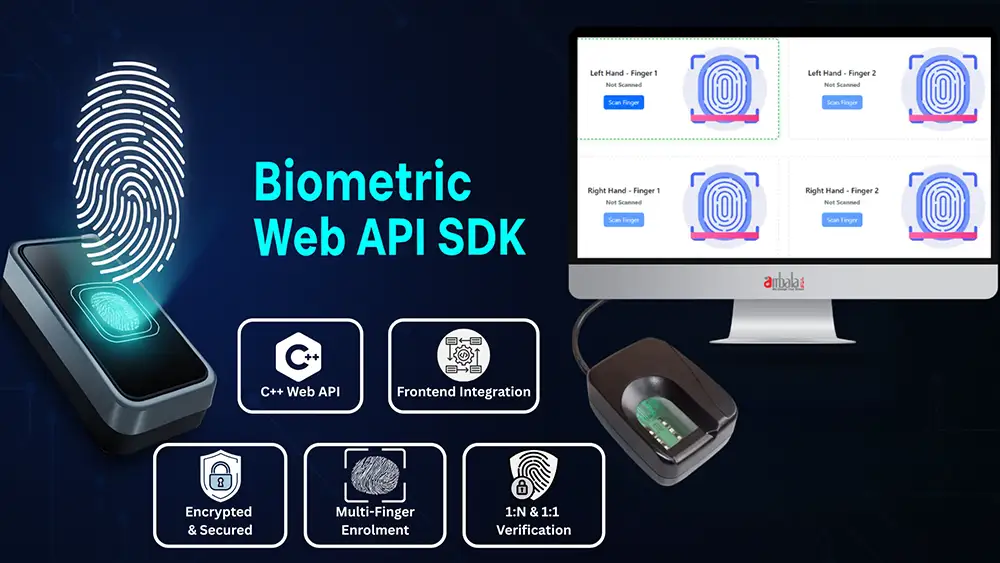

- Enhanced Security: Role-based access, encryption, and audit trails.

- Global Support: 24/7 support with deployment in 3+ countries.

Features of Smart Member Management System

1. Member Management

- Unique identification via Member Code, NID, or Birth Certificate

- NID-based verification with National ID Server integration

- Member transfers across Samity, branches, and products

- Auto-tracking of irregular members and auto-closing

- KYC download system (Active/Inactive)

- Block functionality via NID

- Integrated member admission and exit

- Auto evaluation and activity tracking

- Centralized member history and audit logs

2. Loan Management

- Dynamic loan approval and disbursement

- Regular & one-time loan options

- Flexible frequency setup: daily to half-yearly

- Purpose-based loan size control

- Auto and manual rebate management

- Loan waiver, write-off, and penalty system

- Savings-based loan adjustments

- Full organizational loan rescheduling

- Loan classification: Standard, Watch, Substandard

3. Savings & Deposit Management

- Multiple savings types: Regular, DPS, FDR, Monthly Benefit

- Configurable collection frequency

- Flexible interest distribution and multiple calculation methods

- Auto interest disbursement and maturity processing

- Automated statement & certificate generation

- Target vs achievement tracking

- Staff-wise collection monitoring

4. Regulatory Reporting

- Compliance with international microfinance standards

- Multi-country regulation support

- Automated donor & NGO reporting

- Multi-currency loan & savings reporting

- Consolidated financial reporting for international branches

- Integration with global credit information bureaus

- Third-party access control for auditors and donors

5. Client & Account Management

- Unique client verification using National ID, Passport, or Birth Certificate

- Detailed member profiles with transaction history

- Automated member loan and savings information

- Client photo support and member transfer across branches/centers

- Configurable features for inactive members

6. Search & Browse

- Search clients, groups, and centers by name or ID

- Loan or savings account search by account ID

- Advanced filters: date range, prefix, product type

7. Operational Processes

- Day-end transaction closing

- Validation and authorization before day-end

- Branch & center-level holiday configuration

- Product transfer validation

- Samity/center day adjustments

- Staff and borrower information up to the village level

- Full transactional and operational record management

Benefits of Using a Smart Member Management System

- Enhanced Security: Digital NID verification and cloud encryption protect sensitive data.

- Operational Efficiency: Automation reduces manual workloads and human errors.

- Transparency: Auto evaluation ensures unbiased and fair decision-making.

- Data Accuracy: Eliminates duplicate and incorrect records.

- Scalability: Cloud access allows expansion across multiple branches seamlessly.

Microfinance institutions are crucial to driving financial inclusion, but traditional manual systems slow progress. A Smart Member Management System, powered by NID verification and auto evaluation, transforms operations—making them faster, safer, and more transparent, while empowering MFIs to serve more communities efficiently.