The Growing Threat of Crypto Scams: What We Need to Know

As the cryptocurrency market matures, so do the schemes and scams that prey on both novice and experienced investors. From fake crypto exchanges to sophisticated phishing attacks, the threat landscape is evolving rapidly. In 2025, with billions in digital assets at stake, understanding crypto scams has never been more critical.

While blockchain technology offers decentralized trust and transparency, cybercriminals continue to exploit human vulnerabilities and weak points in the ecosystem. In this article, we’ll break down the most common types of crypto scams, how they work, and what businesses and individuals can do to stay safe.

Types of Crypto Scams to Watch Out for in 2025

1. Phishing Attacks

These scams use fake emails or websites to trick users into giving up private keys or wallet credentials. Even experienced traders can fall victim to well-crafted impersonations.

2. Rug Pulls and Exit Scams

In decentralized finance (DeFi), developers raise funds for a project, then suddenly disappear with investor money. These scams often happen with unverified tokens listed on decentralized exchanges.

3. Ponzi and Pyramid Schemes

Scammers promise high returns with little risk, requiring users to recruit others to sustain payouts. These schemes eventually collapse, leaving most participants with losses.

4. Fake Crypto Wallets and Apps

Fraudulent apps that mimic real wallets or exchanges steal funds or data as soon as users deposit crypto.

5. Impersonation Scams

Scammers pose as celebrities, influencers, or trusted entities, asking followers to send crypto to fake giveaways or charity causes.

6. Pump-and-Dump Groups

These groups artificially inflate token prices through hype, only to sell off and leave late investors with worthless assets.

How to Protect Yourself from Crypto Scams

- Double-Check URLs & Emails: Always verify the authenticity of emails, links, and apps.

- Use Reputable Platforms: Stick to well-known, regulated exchanges and wallets.

- Enable Multi-Factor Authentication (MFA): Add extra security to accounts.

- Research Before Investing: Analyze the token’s whitepaper, project team, and audits.

- Never Share Private Keys: Treat your keys like your bank PIN — never give them out.

- Educate Your Team or Community: Promote regular security awareness training.

The Need for Better Crypto Regulations

Governments and regulatory bodies are catching up, but progress is slow. While decentralization is the core of blockchain, better regulation and standardization can help protect users without sacrificing innovation. Regulatory frameworks for:

- Know Your Customer (KYC)

- Anti-Money Laundering (AML)

- Secure token listing protocols

The Role of Blockchain Security Solutions

Advanced tools and protocols are emerging to detect and prevent scams, such as:

- Smart contract audits

- On-chain analytics and anomaly detection

- AI-driven fraud monitoring

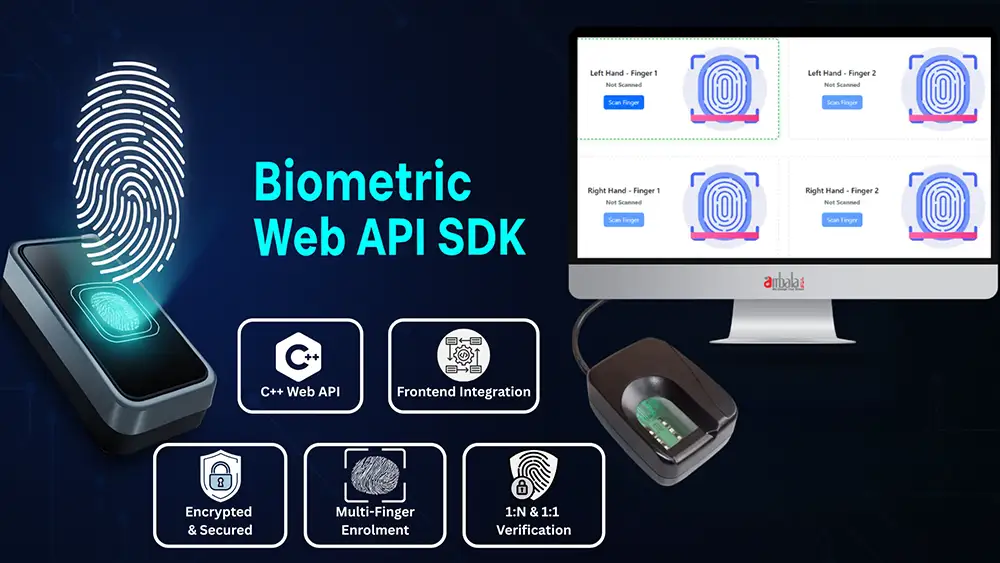

- Decentralized identity (DID) systems

Security startups and IT consulting firms specializing in blockchain are becoming essential partners in helping projects and investors navigate threats.

Crypto scams are not going away — they’re getting smarter. But with the right knowledge, tools, and habits, individuals and businesses can defend themselves. Whether you're a first-time investor or a tech-savvy trader, staying informed is your best defense. Ambala IT helps businesses and developers strengthen digital security, offering blockchain-safe practices, smart contract audits, and fraud monitoring systems.